We understand that, as a broker, it is vital that you really get your clients and what they do. We get what it is to be a broker. We have developed a proposition for brokers which we have coined as “refreshingly traditional.” We have replaced computer-driven responses with actual people. We are here to discuss your client’s risks, to understand their exposures and to provide sound insurance solutions. We want to help you to deal with the curve balls thrown by your clients when they take on a complex contract late on a Friday or require cover for an exciting new business starting today! We will give you someone to talk to. It’s a simple philosophy but one which we believe in.

“That’s been one of my mantras — focus and simplicity. Simple can be harder than complex; you have to work hard to get your thinking clean to make it simple.” – Steve Jobs

From time to time we hear, “the client went with a name they knew” as a reason for not winning a piece of business. We understand that and we want to share our reasons for choosing the insurer partners that we have to help you and your sales process.

Not all insurers are good at all classes of business. Not all insurers share our philosophy and not all insurers offer great cover, a global reach, strong financial security and a history of insuring risks which spans the last 327 years.

2014 was an outstanding year for the Lloyd’s market with profits of £3.2bn. The combined ratio was 88.1% and return on capital was 14.7%. The capital position was further strengthened with net assets of £23.5bn. Lloyd’s ratings were reaffirmed at A+ with Standard & Poor’s, A with A.M. Best and upgraded to AA- with Fitch Ratings.

Lloyd’s has an impressive history. From it’s beginnings in Edward Lloyd’s coffee house in 1688, Lloyd’s has been pioneering in insurance ever since. Your clients can have every confidence that Lloyd’s can meet all valid claims. How can they make this statement? Well, here’s how Lloyd’s manage and use your clients’ premiums:

- All premiums received by syndicates (£45,139m*) are held in trust as the first resource for paying your clients’ claims. Until all liabilities have been provided for, no profits can be released

- Each member must provide sufficient capital to support their underwriting at Lloyd’s The capital (£15,704m*) is held in trust for the benefit of policyholders

- Lloyd’s central assets (£2,578m*) are available at the discretion of the Council of Lloyd’s to meet any valid claim that can not be met by either of the above

*all figures above are as at 31st December 2014

This financial strength is just one of the reasons that Yutree Underwriting have partnered with Lloyd’s. Lloyd’s will continue to be at the forefront of insuring a world threatened by global terrorism, economic uncertainty and climate change. Against a backdrop of several unrated insurers failing in recent years, as your clients’ trusted advisers, recommending Lloyd’s of London should not be a difficult decision.

“It’s coming home to roost over the next 50 years or so. It’s not just climate change; it’s sheer space, places to grow food for this enormous horde. Either we limit our population growth or the natural world will do it for us, and the natural world is doing it for us right now.” ~ David Attenborough

Have a look at Yutree Underwriting’s partners at Lloyd’s:

ProSight Specialty Insurance

Montpelier

C V Starr

Outside of Lloyd’s we also partner with:

W R Berkley

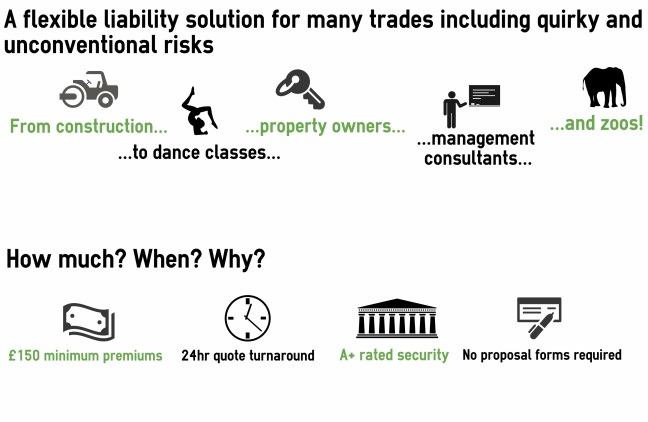

We write employers, public and products liability and contractors all risks and plant insurance with these markets focusing on their individual specialisms and niches to ensure that we are offering you the right market for your clients’ risks. If you would like to know more about our Lloyd’s and non-Lloyd’s markets then please do get in touch with me on 01636 675992 or e-mail me at laura.high@yutree.com

Thank you, as always, for your continued support.

Laura